News

Enterprise Private Cloud Leader VMware Chased by OpenStack

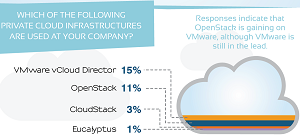

VMware is still the leading provider in the private cloud space, but young open source contender OpenStack is coming on strong, according to new research.

In the public cloud arena, Amazon AWS is No. 1, according to a survey commissioned by Database-as-a-Service (DBaaS) start-up Tesora. The new "Database Usage in the Public and Private Cloud: Choices and Preferences" survey solicited responses from more than 500 North American open source developer communities. As part of research about DBaaS attitudes and usage, the survey asked respondents about what public and private cloud providers they use.

"OpenStack is catching up to VMware as the preferred private cloud platform even though it has only been around for a few years," Tesora said in an accompanying statement. "Of organizations that are using a private cloud, more than one-third now use OpenStack."

The database service being developed by Tesora is based on the open source Trove DBaaS project introduced in the April "Icehouse" release of the open source OpenStack cloud platform. Tesora -- formerly called ParElastic -- launched in February and last week open sourced its database virtualization engine (DVE). It now offers a free community edition and a supported enterprise edition of DVE. The company states it's also developing what it claims to be the first enterprise-class, scalable DBaaS platform for OpenStack.

[Click on image for larger view.]

Tesora says OpenStack deployments are gaining on VMware

[Click on image for larger view.]

Tesora says OpenStack deployments are gaining on VMware

(source: Tesora)

In the Tesora-commissioned survey, 15 percent of respondents reported that VMware vCloud Director was being used as a private cloud infrastructure at their organizations, followed by OpenStack at 11 percent, CloudStack at 3 percent and Eucalyptus at 1 percent. Tesora said that of all organizations using a private cloud, more than one-third use OpenStack.

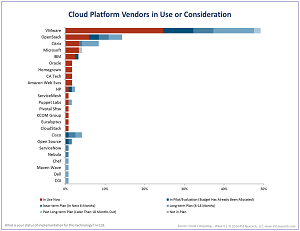

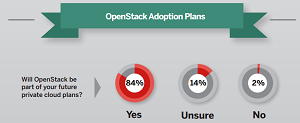

A report caveat noted: "This is a survey of open-source software developers, and surveys of other groups will have different results. For example, a report by 451 Research, "The OpenStack Tipping Point -- Will It Go Over the Edge?" (May 2014) shows a somewhat wider gap between VMWare and OpenStack, while a 2013 IDG Connect survey (funded by Red Hat) found that fully 84 percent of IT decision-makers plan on implementing OpenStack at some point."

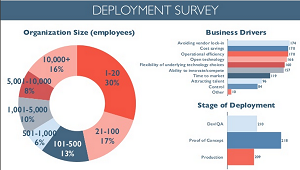

Tesora noted that in OpenStack's most recent survey of its own members, taken last month at an Atlanta conference, found more than 500 OpenStack clouds in production.

[Click on image for larger view.]

451 Research shows VMware's lead over OpenStack is larger

[Click on image for larger view.]

451 Research shows VMware's lead over OpenStack is larger

(source: 451 Research)

[Click on image for larger view.]

IDG Connect report shows wider planned OpenStack adoption

[Click on image for larger view.]

IDG Connect report shows wider planned OpenStack adoption

(source: Red Hat)

[Click on image for larger view.]

OpenStack's user survey deployment chart

[Click on image for larger view.]

OpenStack's user survey deployment chart

(source: OpenStack)

In the public cloud arena, Amazon AWS was reported as the infrastructure being used the most, garnering 24 percent of responses, followed by Google Compute Engine at 16 percent, Microsoft Azure at 8 percent, Rackspace at 6 percent and IBM Softlayer at 4 percent. Tesora said that while Amazon AWS coming in at No. 1 was not surprising, "what is a surprise is that Google GCE was fairly close behind at 16 percent even though it has only been generally available since December 2013."

Tesora said another expected result in the survey findings was that Microsoft SQL Server was the No. 1 database in use for public and private clouds, mentioned by 57 percent of respondents. MySQL was second at 40 percent, followed by Oracle, 38 percent, and MongoDB (the most popular NoSQL choice), at 10 percent.

For both public and private clouds, Web services was the most-reported workload, followed by quality assurance and databases. Cost savings was the primary reason given for implementing a private cloud, followed closely by operational efficiencies and integration with existing systems.

"While more than half of all respondents indicated that they are likely or very likely to use their company’s DBaaS on a private cloud, 31 percent plan on implementing or have implemented DBaaS in a private cloud," noted Tesora in reporting on further survey findings. "Of the people who are interested in DBaaS, nearly all of them were looking for relational DBaaS. Roughly a third (34 percent) of those people were interested in NoSQL DBaaS."

The survey report also made the following statements:

- The results suggest that relational databases still dominate despite rapid adoption of NoSQL solutions by high-profile enterprises like Twitter and Facebook.

- Only 5 percent of respondents were doing any kind of Big Data/data mining/Hadoop workloads, suggesting that the marketing hype around 'Big Data' may be ahead of reality.

- The results also indicate how mainstream cloud computing has become, with more than half of respondents reporting that their organizations are using public clouds, while 49 percent are using private clouds.

Tesora noted that respondents were early adopters of new technology and the survey provided a snapshot of OpenStack and DBaaS in early stages of development. "It's encouraging to see the traction of OpenStack in this early adopter segment of the private cloud market," said Ken Rugg, CEO of Tesora. "These findings are important because they are leading indicators of the kinds of technology and architecture decisions we can expect to see as private cloud adoption explodes and OpenStack matures and more vendors and customers go down this open source path."

Tesora used SurveyMonkey to conduct the survey, while The Linux Foundation, MongoDB and Percona helped distribute the survey

About the Author

David Ramel is an editor and writer at Converge 360.